tesla tax credit 2021 colorado

Registered in Colorado to qualify for the credit. Tax credits are as.

Electric Car Tax Credits What S Available Energysage

The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019.

. Most Tesla cars sold starting on January 1 2022 would be eligible for an 8000 or 10000. Save time and file online. The tax credit for most innovative fuel vehicles is set to expire on January 1 2022.

The Model Y is one of Teslas best-selling cars but does it qualify for the 7500 federal tax credit. Since you asked about CO state tax the result was an entry of 5000 on line 22 of the 2017 form DR 0104 and the system added a Colorado 2017 form DR 0617 with the data. The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased.

The renewal of an EV tax credit for Tesla provides new opportunities for growth 2. The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019. Tesla tax credit 2021 colorado Sunday March 6 2022 Edit.

Colorado EV Incentives for. Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles. Colorado EV Incentives for Leases.

To the extent that the amount of the credit exceeds tax the excess credit is refunded to the taxpayer. If you lease cars or trucks for your business you also qualify for the Colorado electric-vehicle tax credit under Income 69. You do not need to login to Revenue Online to File.

Contact the Colorado Department of Revenue at 3032387378. 1 Best answer. The table below outlines the tax credits for qualifying vehicles.

March 14 2022 528 AM. The credit is refundable. Tesla is installing Tesla.

You may use the Departments free e-file service Revenue Online to file your state income tax. Light duty electric trucks have a gross. Standalone Powerwall Residential Federal Investment Tax Credit For Systems Installed In.

Since then Tesla buyers havent qualified for a tax credit. Tesla already reached its previous tax credit allotment in 2018 by selling more than 200000 vehicles. Latest On Tesla Ev Tax Credit February 2022 Why Texas 2 500 Electric Car Incentive Won T Apply If You Buy A.

Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle. Some dealers offer this at point of sale. Based on the Model 3 sedan the Tesla Model Y is a battery electric.

Any vehicles purchased after that date are no. The effective date for this is after December 31 2021. EV Federal Tax Credit for 2021 Tesla I purchased my Tesla Model Y in late Feb.

The credits decrease every.

/images/2021/04/02/red-tesla-vehicle.jpg)

Is A Tesla Worth It We Compare All The Numbers To A Normal Car Financebuzz

What Does 24 500 To 37 000 Tesla Model 3 Mean For The Us Auto Market Cleantechnica

New Ev Tax Credit When Should You Buy An Ev Yaa

Can Fort Collins City Government Convince You To Buy An Electric Car

Considering An Electric Car The Build Back Better Bill Could Save You Thousands Cbs News

State Electric Vehicle Tax Credits Electric Hybrid Alternative For 2022

Electric Vehicle Solar Incentives Tesla

Electric Cars For Sale In Colorado Springs Co Cargurus

Most Popular Electric Vehicles Don T Qualify For Texas Ev Rebate Program Texas Thecentersquare Com

Here Are The Cars Eligible For The 7 500 Ev Tax Credit In The Inflation Reduction Act Electrek

What S Behind Tesla S 1 Trillion Market Valuation World Socialist Web Site

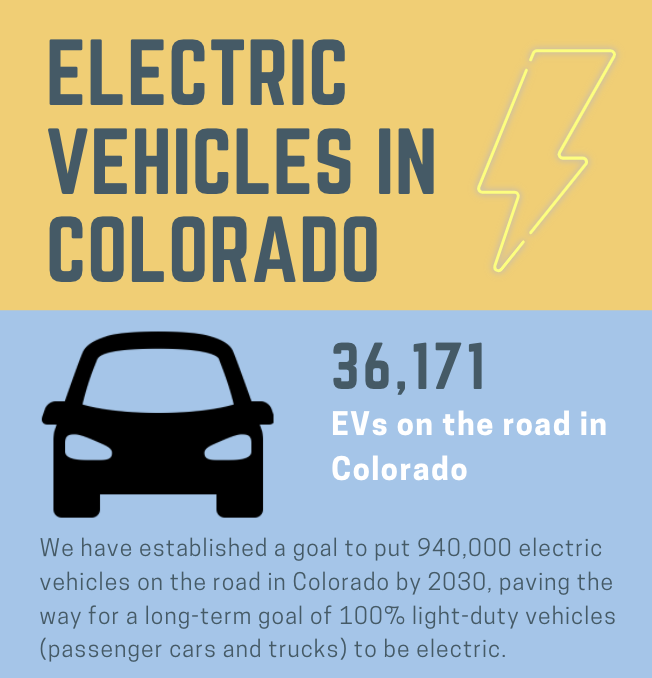

Electric Vehicles In Colorado Report May 2021

Pre Owned 2021 Tesla Model 3 Performance 4d Sedan In Houston Tx 53025 Autosavvy

Eligible Vehicles For Tax Credit Drive Electric Northern Colorado

Tax Credits De Co Drive Electric Colorado

Ride Share Driving With A Tesla Model 3 De Co Drive Electric Colorado

Which Tesla Models Qualify For The Ev Tax Credit In 2023 Leafscore